Millennials are those who rise and develop accompanied by technology that grows so fast. So, it is not surprising that they are often seen in coffee shops for hours while facing their laptop. But it turns out to be a global millennials picture.

But Indonesian millennials are different. They don’t just want to look cool and follow the trends, but they really have a calculation for their future. The research that has been carried out by KG Media below has succeeded in discover findings that defy the myth that millennials only want to have fun now.

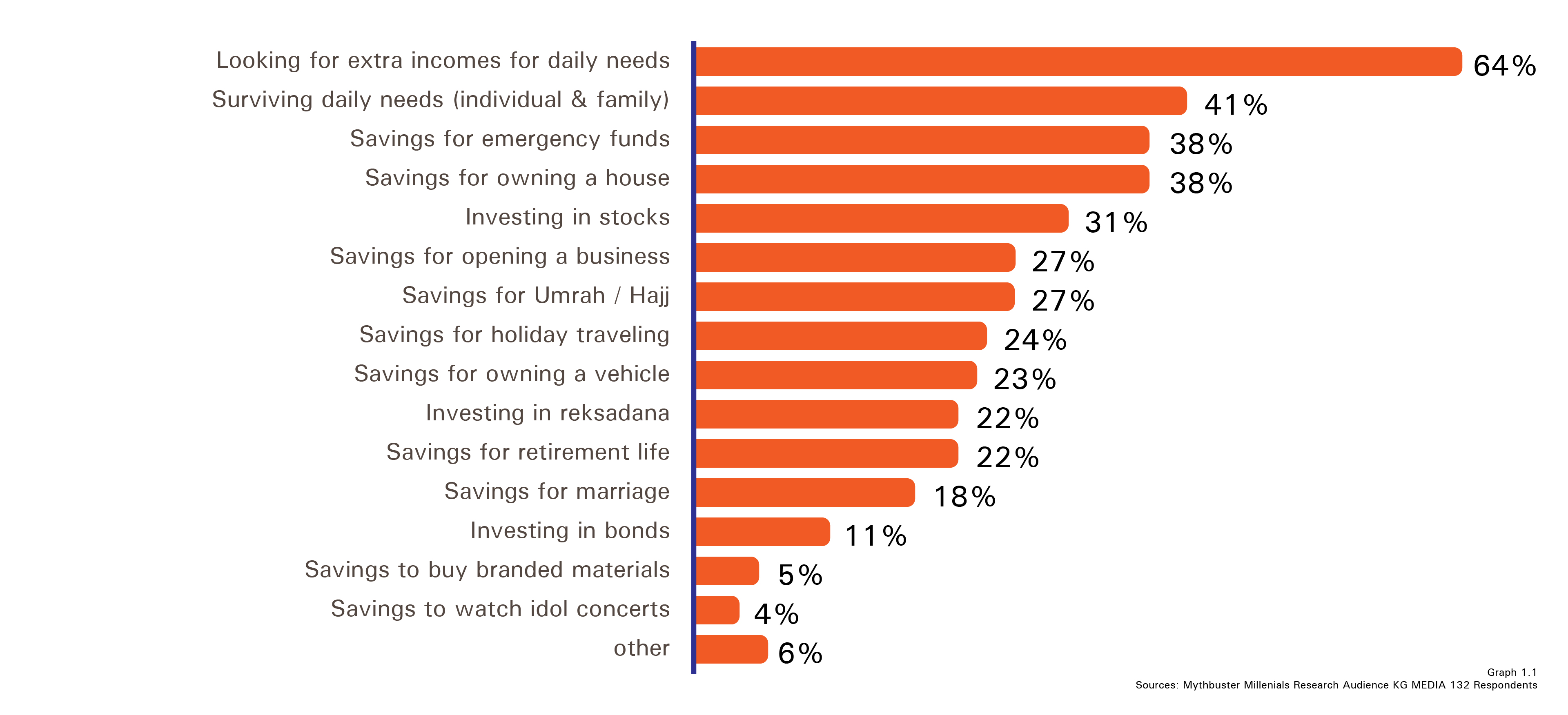

From the findings above, Indonesian millennials struggle to get whatever they need by working, include looking for additional income to be independent.

Still from the same data, there are several interesting things that can be considered. 38% of them want to have an emergency fund, followed by 38% who want to have savings for a private house, 31% want to own shares and up to 27% want to have business savings. This data confirms that millennials are a group of generation who are not only thinking about themselves in the present, but also preparing for the future.

Preparing themselves for the future makes them look for additional income from the other work or business. So that later they can have some savings and own shares. This can be an insight for brands that are in the financial and banking sphere, so that they can prepare products or better communication their related products to support millennials future life.

Calculating the Future is a Sign of Self Reward

In addition, there are other interesting things that are connected. In general, millennials, both global and Indonesian, are a generation that thirst for praise, a great desire to be praised – therefore, they have a self-reward concept which has become a necessity in itself.

Working in one month and getting a salary, there is an amount of money that they set aside to get self-rewards. There are egos and emotions that they have to “feed” within.

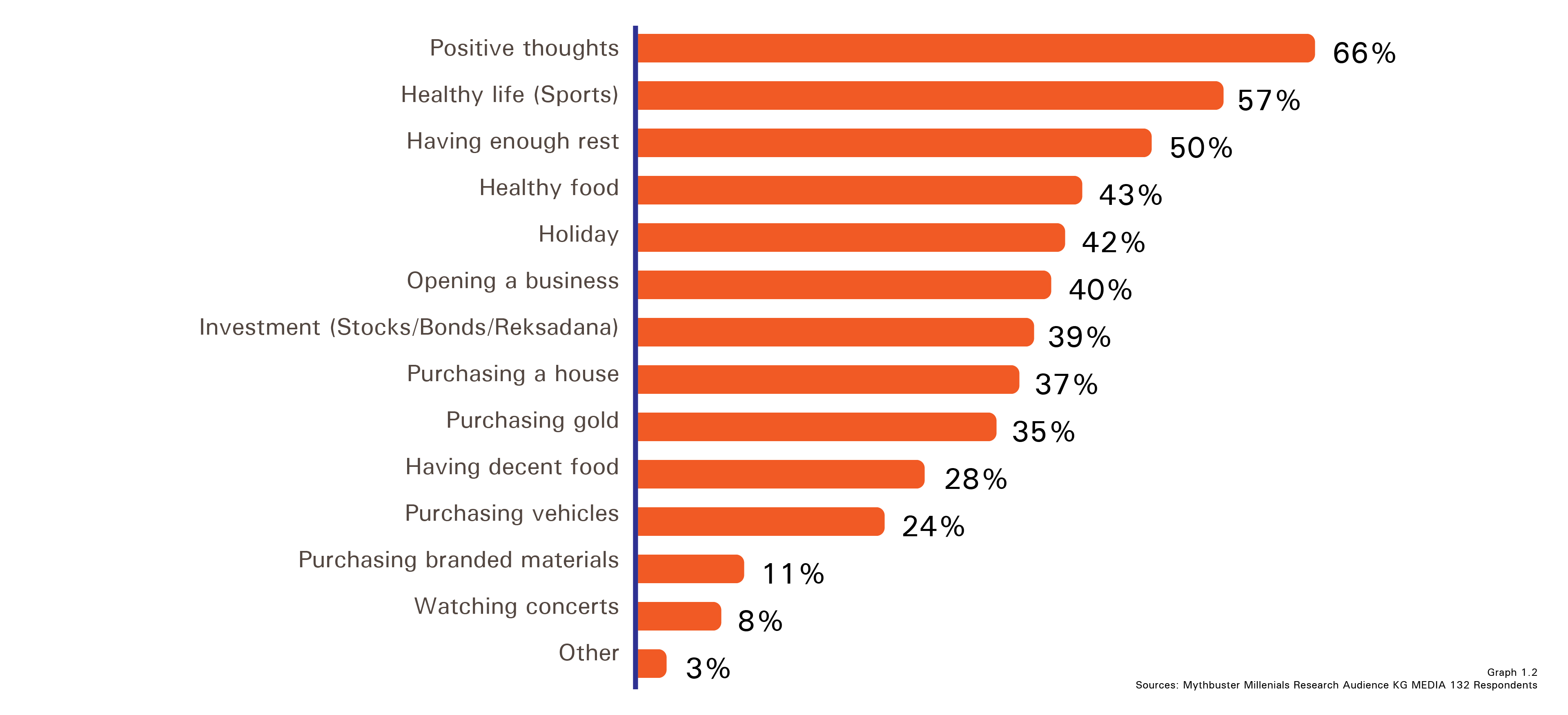

But, is self-reward always related to mere pleasure? Such as getting vacation, getting well treatment at a spa, or at least having culinary tour at their favorite restaurant? With the data below, there are several interesting things that can be considered.

It can be seen in rank 1-5 that the desire for self-reward is still about things that please millennials egos and emotions. But in rank 6 and 7, there are 40% of them who set aside an amount of money to open a new business as their self-reward.

In rank 7, there are 39% of millennials who are conscious to separate their income to an investment. The forms of investment are quite diverse, ranging from stocks, bonds, to mutual funds.

Based on the data above – is the millennials generation still considered as a bunch of youth which does not thinking about the future? It seems that the current condition and various technological advances that exist now, it made them getting self-reward with long-term benefits easier.

Advance Technology: What Do Millennials Need?

From the previous explanation, it can be seen that millennials consciously separate an amount of their earnings to get ‘unusual’ self-reward. This point can be one of the benchmarks for a brand to tap into such a condition.

In terms of separating an amount of money for the self-reward, technology should facilitate their needs. Like a savings account which can be accessed easily from a smartphone.

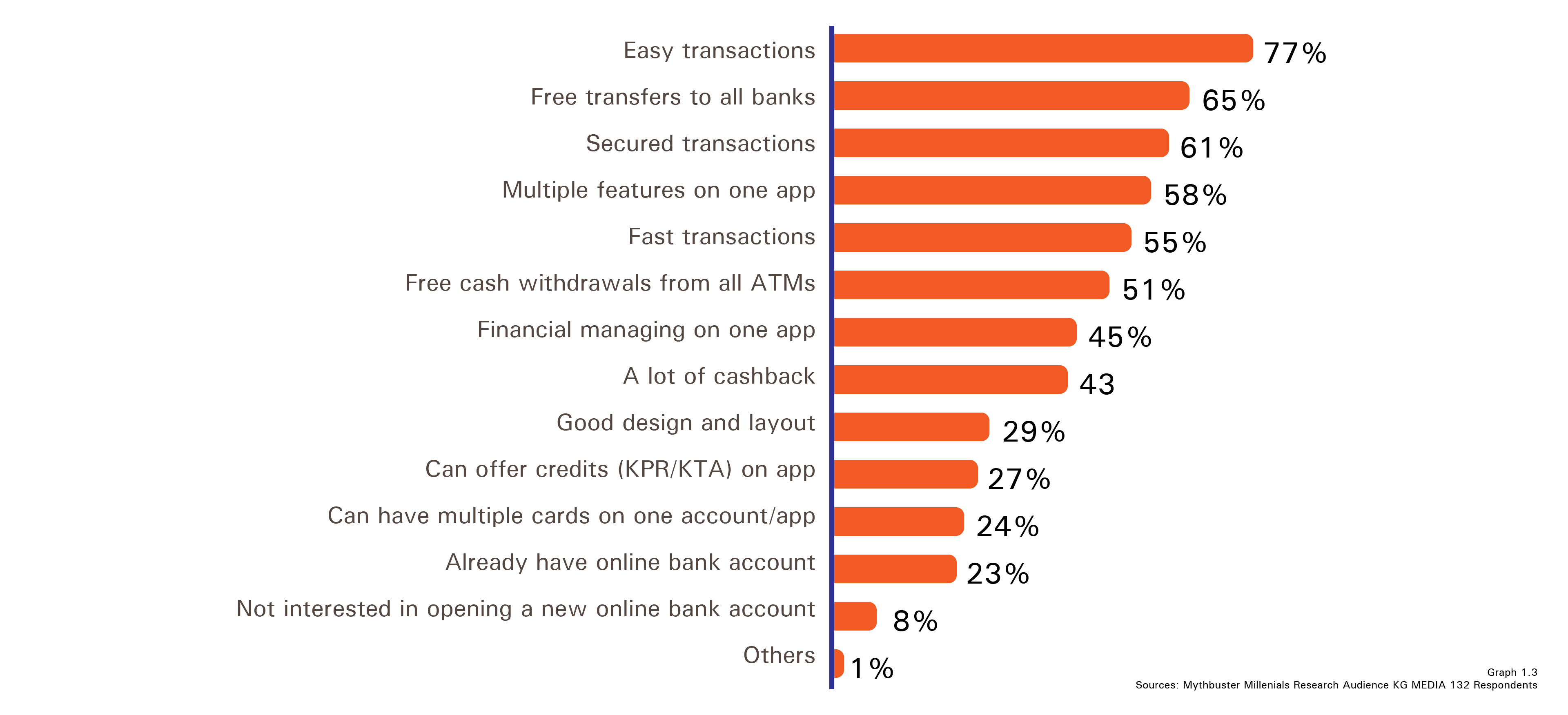

This high mobility certainly makes millennials achieving their desires easily. Regarding this fact, here is the data from research conducted by KG Media which states how many millennials are interested in opening and accessing savings accounts online.

Their interest in opening savings online is quite high compared to those who are not interested. This certainly opens up opportunities for brands who are in the financial to banking sector to be present in online savings products among millennials.

From the data above, a red line can be drawn where millennials seem to need a separation for the amount of cash that they have regarding the desire to fulfill the self-reward.

In addition, the data above also shows that the presence of advance technology for millennials financial and banking affairs is important to pay attention to. Cashback? Only 43% seem interested in opening an online savings account because of that feature.

In fact, the most important thing is a matter of experience. In the first place, there is the ease of transaction that reach 77% as the main reason for millennials open savings online account. This is also supported by data which states that 55% of them want fast transaction speed, up to 29% want an easy-to-understand application design that is also comfortable to use.

So, What Can Be Done?

Based on all the explanations from the data above, there are several important things worth taking notes for Brands.

- First, millennials have consciously separated an amount of income for their future.

- Second, millennials want the convenience of making this separation. In this case, is open an online savings account.

- Third, millennials state that this convenience is a pleasant experience, both in opening or accessing online savings account from their gadgets.

So, what brands can do is improving the technology side of the products and services offered to millennials. Starting from easy-to-understand user interference and user experience application design, easy-to-follow instructions and also page speed at every step in the application. These are some of the main things that brands can do to fulfill millennials desire that turn out to be taking into account future.

For more information contact us here or visit us in stratx.id