Investment is an important thing that needs to be taught and practiced from young age. Investment results can be used for various needs, such as savings or emergency funds that can be used in the future.

JakPat (Jajak Pendapat) recently conducted a survey on investment. This survey was conducted online through the JakPat application on 4-6 July 2022 and received 2,411 respondents spread throughout Indonesia.

As a result, the majority of Indonesian people have been investing since they were young. There are 85% of respondents who think that investment is important. Meanwhile, another 15% of respondents considered investment is unimportant thing.

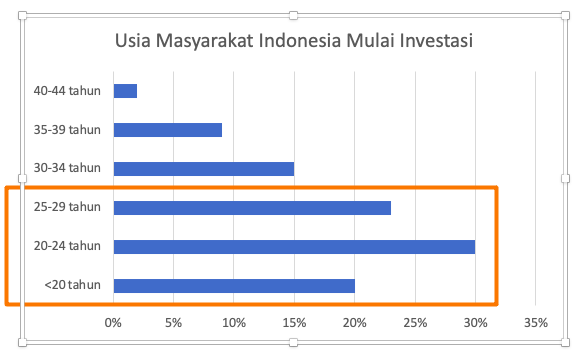

From the respondents who considered investing is fundamental, 73% of them said they had been investing since they were under 30 years old.

As many as 20% of respondents said they had started investing from the age of under 20 years. Then, there were 30% of respondents investing from the age of 20-24 years and 23% of respondents stated that they had investing from the age of 25-29 years old.

When we compared to the age group of 30 years and over, it can be seen that young Indonesians are very enthusiastic about investing. There is something that makes these young people and wider Indonesian community feel confident in deciding to do investment.

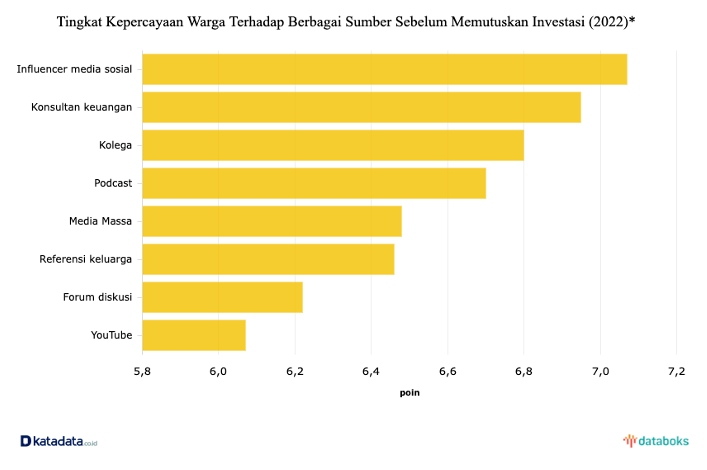

Based on the results of a survey conducted by CELIOS (Center of Economics and Law Studies) and Pluang this year, the majority of respondents trust influencers on social media before investing.

This survey was conducted on 3,530 respondents who were randomly selected in June 2022. The majority of respondents came from Java and Bali and were in the 24-35 years age group with the majority them are private employees.

Financial influencers on social media are the most trusted figures when respondents want to make investment considerations. This trust is shown by a score of 7.07 points out 10 points.

Furthermore, financial consultants and colleagues occupy positions 2 and 3 as figures who can be trusted to provide recommendations for investment considerations.

Another interesting finding from this survey is the value of money that spent by Indonesians to invest.

As many as 61% of respondents only spend less that IDR 1 million to invest from their monthly income. Then, as many as 31% of respondents spent around IDR 1 million to IDR 5 million to invest. There are also as many as 5% of respondents who can spent IDR 5 million to IDR 10 million to invest.

The diversity of the amount of money spent to invest also shows the variety of reasons people are willing to spend that amount of money.

This survey also found several reasons for the respondents to invest. The majority of respondents as much mas 36% want to increase their passive income. Then, followed by other reasons such as emergency fund preparation, retirement preparation, children’s education, and others.

So, What Can We Know Now?

Key Takeaway 1

The decision to invest the majority of Indonesian society

due to financial influencers on social media.

Current technological advances have made Indonesian people able to learn anything and anywhere. Like learning about investment, instead of reading thick literacy books, attending seminars, most of them just open social media and learn from there.

This shows the tendency of the Indonesian people needs information that is concise and clear. Then, they also tend to be more engaged if there is a ‘role model’ that is relevant to them. This may be due to the attitude of the role model which does not seem patronizing, but still conveys information that the Indonesian people need about investment.

This finding needs to be underlined by brands or investment service providers to gain the trust of the Indonesian people so they can use brands’ products or services. No longer need hard selling – but find someone who is relevant to the target audience.

By finding a relevant person, consumers will assume that they have a ‘friend’ who is ready to help them to make investment decisions. As a side note, the communication that needs to be issued from this figure is communication that is straight forward but does not seem to dictate.

Key Takeaway 2

The majority of Indonesian people avoid risk when investing.

It is quite surprising that the majority of Indonesian people have invested from a young age, but most of them only spend less than IDR 1 million for investment.

This refers to several trends.

The first tendency is that the majority of Indonesian people are risk averse in investing.

Then, the second tendency is that those who invest at a young age do not have an enough income to meet all their needs, but there is already a great desire to do investment.

The next tendency, related to the main reason for investing is to get additional income or passive income – the majority of Indonesian people are FOMO and put their money in high-risk investment instruments such as cryptocurrencies and stocks.

Indeed, there is nothing wrong with investing with the aim of getting passive income. However, this shows that the financial literacy of the majority of Indonesian people needs to be improved. Instead of pursuing additional income, this part of Indonesian society needs to pay attention to other benefits from investment.

Such as preparing for recession issues, retirement savings, or savings for children’s education, and many other benefits.

Seeing this possibility, brands need to pay more attention to the communications that have been built before. Apart from communicating in a ‘beneficial’ tone – brands can prepare communications in a ‘safe’ tone. That is, the brand must be ready to tell how the benefits of long-term investment with the appropriate instrument.

Preparing the right communication and strategy is a big step for brands to take now.

If you are interested in collaborating with us to get deeper insight and effective strategy, please contact:

faisyal.firdaus@stratx.id

08118003404